Understanding and designing your Chart of Accounts in QuickBooks

September 18, 2017 by Ed Becker

The Chart of Accounts is the starting place for any accounting system, including QuickBooks, because it is here that each General Leger Account is defined. From here, you can quickly learn where the money is, where it came from and where it’s gone to.

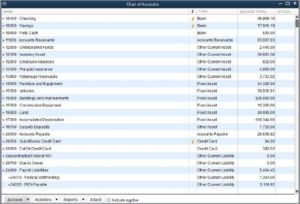

The Chart of Accounts in QuickBooks

As illustrated below, the Chart of Of Accounts is divided into three main columns: the Name, its Type and the Balance Total. There are also two smaller columns to indicate online banking and another to show if any documents are attached.

The Chart of Accounts

When you start work on a new company, QuickBooks guides you through the process of setting up a Chart of Accounts. It starts by offering choices of charts of accounts, each relevant needs of your company. One of QuickBooks’ strongest suits is its ability to interface for one of 30 industries, and you can later modify any of them for the specific needs of your company. One of QuickBooks’ strongest suits is its ability to interface with Microsoft Excel, and you can actually import a Chart of Accounts from Excel.

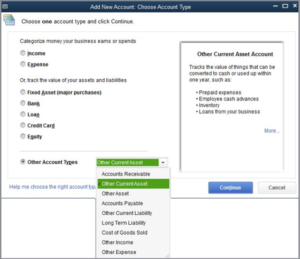

Account Types

These are fundamental to any accounting system, QuickBooks included, and they will be very familiar to the experienced bookkeeper. The simplest way to classify them is as to whether they are Income or Expense items that and ultimately appear on Profit aAnd Loss reports, or if they are Asset, Liability and Equity accounts that ultimately appear on the Balance Sheet. As a quick review:

Income and Expense items:

- Income

- Expense

- Cost of Goods Sold

- Other Income

- Other Expense

Asset Accounts:

- Fixed Asset

- Bank

- Accounts Receivable

- Other Current Assets

- Other Asset

Liability Accounts:

- Loan

- Credit Card

- Accounts Payable

- Other Current Liability

- Long Term Liability

Equity Accounts

These vary with the type of entity your company is, e.g.: Sole Proprietor, S-corporation, etc.

Defining the account’s type is fundamental to our next section: Adding a New Account to your Chart of Accounts

Adding a New Account to your Chart Of Accounts

You can do this by either clicking the Account choice on the bottom tool bar on the Chart of Accounts window or simply by pressing Ctrl+N.

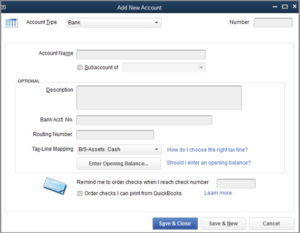

After you determine the type of account you wish to wish to add in the window illustrated above, the Add New Account window appears where you can further define the account you are creating.

New Account Window

Here, on the very top of this window, you chose which Account Type, as defined in the previous section, that you are adding. Another important choice is to decide if this is a sub-account. For instance, you can define a Professional Sales account, and later, you can define sub-accounts to Professional Sales, such as Accounting Services Sales and Legal Services Sales. This way, when you look at Profit and Loss reports, you will not only know how much you made overall in Professional Sales, but in both sub-accounts separately.

Making Changes to the Chart of Accounts

Merging Accounts

Merging accounts is an action that you should make conscientiously as there is no easy way to undo it. Do keep in mind that only the same account types may be merged. Please read your guide for detailed directions.

Rendering an Account Inactive

If, for whatever reason, you no longer want to use an account, you can render it inactive. You can do this by Right-clicking the account and choosing Make Inactive.

Deleting an Account

You can also completely delete an account. You do so by right-clicking the account, and this time choosing Delete Account.

Congratulations!

Now that you understand the Chart of Accounts, you’ve taken a major step in learning about QuickBooks, and indeed, in understanding the complete processes of bookkeeping and accounting. With the understanding of what accounts are, in our next blog we can define the ITEMS that make up what we buy and sell during the course of our company’s business operations. Stay tuned!

Category: Small Business

Tags: accounting, chart of accounts, QuickBooks